Broker Relations

Hello Capsuleers,

One of the guiding principles for the market in EVE Online is to keep intact how closely it mirrors aspects of real-world economics and financial markets. These principles are held firmly in mind when moving forward with any changes to the in-game market.

The Broker Relations update will be launching 10 March, and included in the release will be changes to the mechanics around creating and updating orders on the in-game market.

Last summer, permanent changes to both the sales taxes and broker fees for the market were implemented. Having monitored player behavior before and after these summer changes to taxes & fees, further alterations to the market will be made. These are highlighted in full below.

The intent behind these upcoming changes is to support a healthy and live open market, allowing competition to remain fair between players. The prohibited use of automation techniques used by malicious players on the in-game market is a frequent subject of discussion, so there is absolute commitment to fighting bots in New Eden. Needless to say, the market and the behaviors of players when these changes go live will be closely monitored.

Summary of changes

Here's an overview of the changes that are being made. A more detailed breakdown and justification follows afterwards.

- Introducing tick size - a limit on price precision when creating/updating an order. An order's price can only be specified with a maximum precision of 4 significant figures.

- In Upwell structures, the minimum broker fee that can be configured by the structure owner increases from 0% to 1%, adding an ISK sink to these market fees by paying half of this incoming fee to an NPC.

- Increase the ISK fees that are charged when modifying an order. The fee includes a new additional component, the Relist Charge. This is in addition to the regular Broker Charge that covers the increase between old and new order value.

- Change the benefits (and name) of the Margin Trading skill - it becomes the Advanced Broker Relations skill. This will now give a reduction in the Relist Charge. The skill's old ability to create a Want-To-Buy order with only partial ISK escrow is removed, so all WTB orders will require 100% escrow to be paid up front.

Introduce price precision to EVE market orders through tick sizes

Change: Order prices can only be specified with a maximum precision of 4 significant figures.

Currently in EVE, all order prices can be specified to a 0.01 ISK precision, regardless of the magnitude. This will be changing and will use discrete ticks to a precision of four significant figures.

As an example, the following list shows the only acceptable ticks around the 1 million ISK region. All prices must be exactly set to one of these tick levels, and intermediate values will be rounded up/down to the next tick.

1,112,000

1,111,000

1,110,000

1,109,000

...

1,002,000

1,001,000

1,000,000

999,900

999,800

999,700

Important note: Existing orders at the time of this change coming into effect will keep their current pricing. If such an order is subsequently modified, then the new price must conform to the new tick rules. It will therefore take up to 90 days (the maximum player order duration) until all player orders fit this new rule.

As discussed above, there is a desire to follow some real-world examples in how markets can operate, so this change is heavily influenced by the way that regular stock/commodity markets handle pricing. There's more information here and here out there for those that are interested in reading more on this subject.

Increasing the minimum fee for player-hosted markets, and adding a new ISK sink

Change: Broker Fee payments in structures are split equally between the structure owner and an NPC. Increase the minimum fee setting to 1% (from 0%).

For orders placed in an Upwell structure, the Broker Fee is paid to the structure owner instead of being sunk out of the game. Therefore the fees do not represent the same true cost compared to NPC stations. It is not uncommon for structure owners to give themselves and their friends a 0% fee, meaning that they can effectively list and modify orders without limit or cost. Therefore two changes are being made to markets in Upwell structures:

- The minimum broker fee that can be configured by the structure owner increases from 0% to 1%. Existing structure settings that are currently below 1% will be updated to this new minimum. For reference, this 1% compares to the 3%-5% range that is possible at NPC stations (depending on skills and standings), so player-hosted markets will continue to be the most competitive places to run a trade empire.

- Charging structure owners a new tax on this broker fee income. When the owner receives their 1% fee, they will immediately pay half of it onward to the Secure Commerce Commission. This new ISK sink ensures that these markets contribute positively to the health of the in-game economy, and also to server/database health by adding a non-zero cost to large-scale order creation/update spam.

Increasing the cost of order modification

Change: Increase the ISK fees that are charged when modifying an order. Change the benefits (and name) of the Margin Trading skill to become Advanced Broker Relations, which will now give a reduction to these modification fees.

Last summer some alterations were made to sales taxes and brokers fees for the market. There will now also be changes to the fees for modifying active buy/sell orders.

Currently, the cost to modify an order by a small amount is negligible. The only real constraint is the five minute delay before an individual order can be modified, but this is relatively easy to minimize for a trader with many order slots. As a result, the optimal strategy becomes "Always create your orders at 0.01 ISK above/below the current best order, and always update your order ASAP by 0.01 ISK if it isn't the highest buy or lowest sell." Competition between traders comes down to who (or what) can micro-manage their orders for the longest period of time, rather than who is making the most intelligent pricing decisions. Instead, this will provide some incentive for order changes to happen less frequently and with more consideration. Increasing the modification costs will mean that the strategy of always modifying every order as quickly as possible will quickly become unprofitable. Creating a more equal playing field for market users and handing the advantage back to those who make educated pricing calls is a clear statement of intent in the fight against botting.

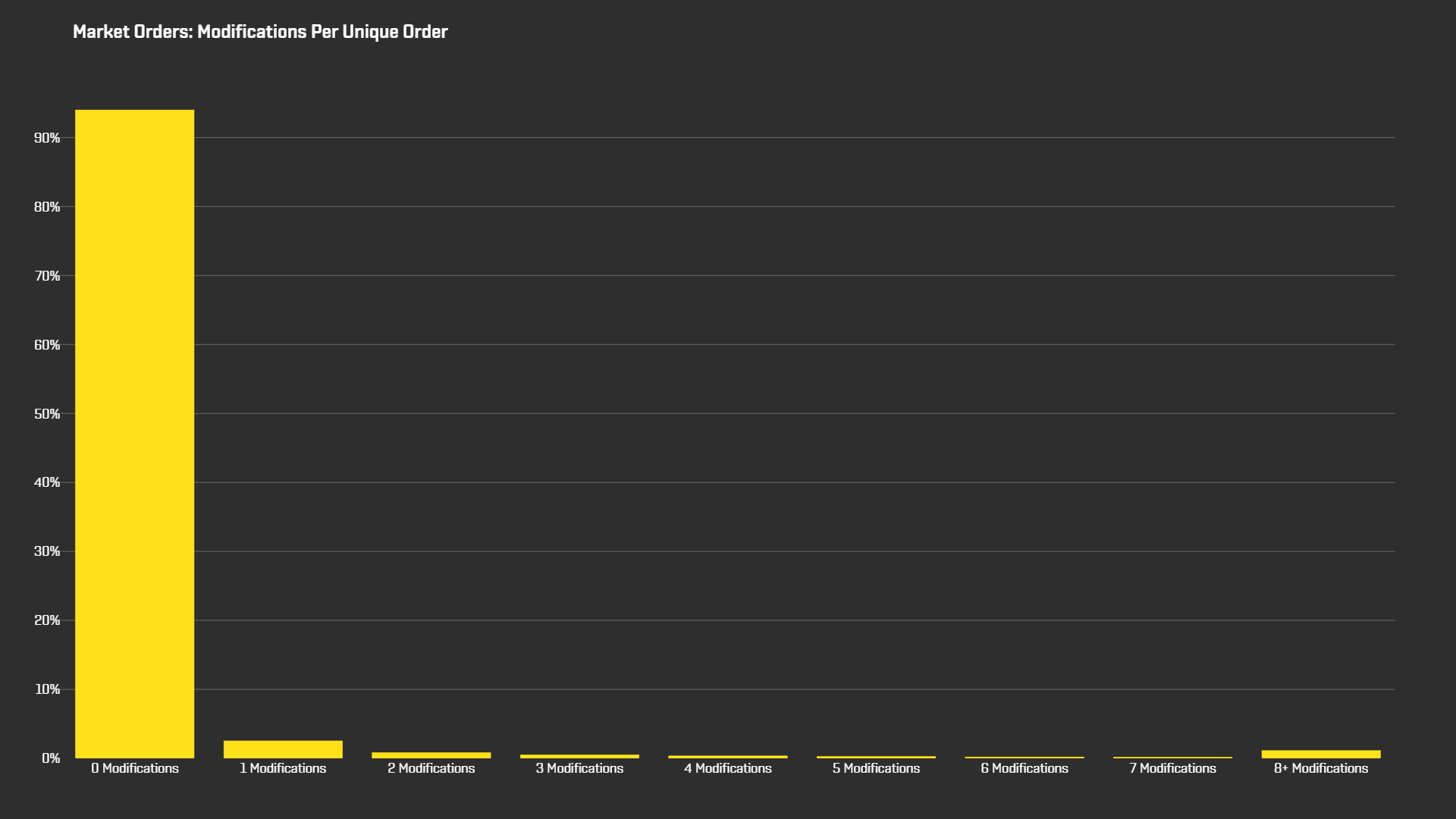

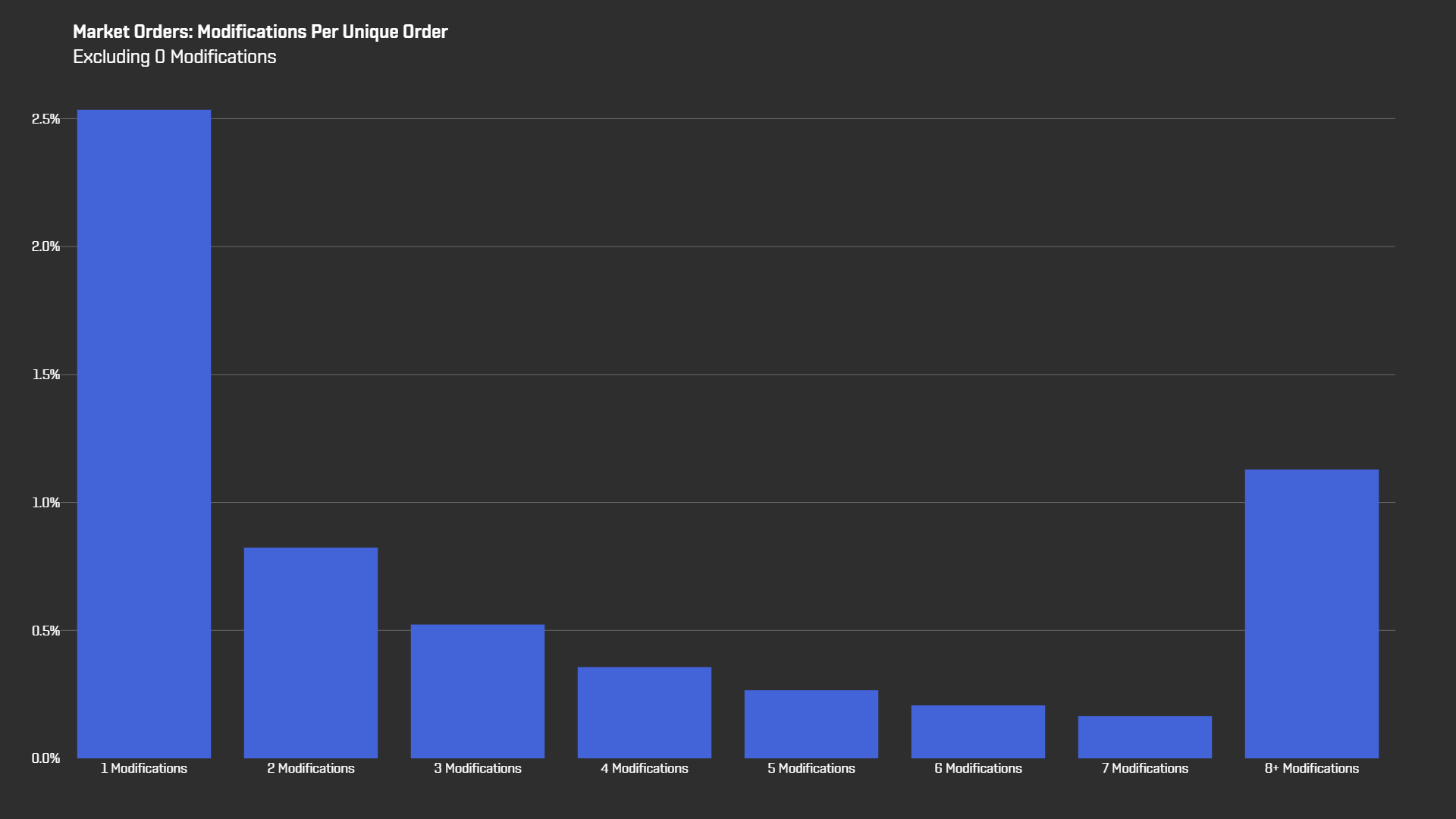

The graphs below show the data for which modifications were made to unique market orders over the course of 30 days. Note that the second graph is just a zoomed-in version of the first, with the initial "0 modifications" column removed.

This shows that the significant majority of orders (approximately 94%) never get modified at all. The costs associated with these orders will not be negatively affected by these changes. It is also evident that around 2% of orders are modified more than five times. For these orders, the modification fees will start to eat into the profit margins. A tiny minority of orders (less than 1.3%) are modified more than eight times. Among these are orders that are being modified hundreds of times, with behavioral patterns that are very likely not human. With these changes, such excessive behavior will quickly lead these market-addicts to bankrupt themselves.

The way this is being changed is the introduction of a "Relist Charge" component into the modification fee. This Relist Charge will be a function of the new price, rather than the delta between old and new. A skill-based way to lower (but never eliminate) the Relist Charge will also be provided.

Formula

- BR is the character's effective Broker Fee rate at the station/structure (factoring in skills/standing/settings as appropriate)

- RD is the character's Relist Discount rate (factoring in Advanced Broker Relations skill)

Fee to create a new order at price P (this is unchanged):

Fee = BR * price

Fee to modify an existing order, changing price from P1 to P2:

Fee = max(0, BR * (P2 - P1)) + (1 - RD) * BR * P2

Note: Both types of fee will have a minimum charge of 100 ISK

Example #1:

- Character has Broker Rate of 3% (from skills/standings) and has a Relist Discount of 60% (from Advanced Broker Relations skill)

- Character creates a sell order for 2,000,000 ISK. They are charged a fee of 60,000 ISK, calculated as follows:

- BR * 2,000,000 = 60,000

- Character then drops the price to 1,950,000 ISK. They are charged a fee of 23,400 ISK, calculated as follows:

- 0 + (1-RD) * BR * 1,950,000 = 23,400

- *(In this case, the delta is negative, so the first part of the fee is 0) *

- 0 + (1-RD) * BR * 1,950,000 = 23,400

- Character then drops the price again to 1,900,000 ISK. They are charged a fee of 22,800 ISK, calculated as follows:

- 0 + (1-RD) * BR * 1,900,000 = 22,800

- These two modifications cost them a total of 46,200 ISK

Example #2:

- Character has Broker Fee of 3% (from skills/standings) and has a Relist Discount of 60% (from Advanced Broker Relations skill)

- Character creates a buy order for 2,000,000 ISK. They are charged a fee of 60,000 ISK, calculated as follows:

- BR * 2,000,000 = 60,000

- Character then raises the price to 2,050,000 ISK. They are charged a fee of 26,100 ISK, calculated as follows:

- BR * (2,050,000 - 2,000,000) + (1-RD) * BR * 2,050,000 = 1,500 + 24,600 = 26,100

- Character then raises the price again to 2,100,000 ISK. They are charged a fee of 26,700 ISK, calculated as follows:

- BR * (2,100,000 - 2,050,000) + (1-RD) * BR * 2,100,000 = 1,500 + 25,200 = 26,700

- These two modifications cost them a total of 52,800 ISK

Note: Modifying an order will reset its duration back to the original. Therefore, the modification fee also reflects the fact that the order creator is able to extend the lifetime of an order indefinitely.

Changes to the Margin Trading skill

As mentioned above, a way to reduce the modification fee with a skill is being provided. Rather than introduce a new skill, the debated Margin Trading skill is being re-purposed, which also ties into the EVE Online's strong new player focus.

The existing Margin Trading skill will be changed into Advanced Broker Relations. The skill's former ability to reduce the amount of ISK placed into escrow when creating a buy order is going to be removed. It will be replaced with an ability that provides an increasing discount to the Relist Charge.

The skill will keep its existing rank. Any points trained into Margin Trading will now apply to Advanced Broker Relations instead.

Here's the description of the skill in its new form:

- Proficiency at negotiating the brokerage cost of relisting a market order at a new price. Each level of this skill adds 5 percentage points to the standard Relist Discount of 50%.

- SCC regulations aimed at reducing market volatility mandate a cost for relisting a market order based on the Broker Fee rate applicable to a given market order at the time of the price change.

- The total brokerage costs for relisting are calculated in two steps:

- The full Broker Fee rate is applied to the increment by which the price has changed if the new price is an increase to determine the brokerage cost of raising the asking price. If the new price is a decrease this component of the brokerage cost for relisting is zero.

- A Relist Discount is then applied to the Broker Fee rate and the discounted rate then applied to the total new price. The resulting amount is added to the increment charge calculated in the first step.

- The total calculated in these two steps is the brokerage cost that will be charged for relisting the market order at its new price.

- The standard Relist Discount on the total price brokerage fee has been set by the SCC at 50%. Advanced Broker Relations increases that discount by 5 percentage points per level, permitting a discount of 75% at level 5.

Here's a table showing the Relist Discount at each level:

| Margin Trading Skill Level | Relist Discount |

|---|---|

| 0 | 50% |

| 1 | 55% |

| 2 | 60% |

| 3 | 65% |

| 4 | 70% |

| 5 | 75% |

Important note: The Margin Trading skill will no longer provide its current ability to reduce the amount of ISK placed in escrow when setting up a buy order. Existing orders that were placed prior to this change will continue to operate as before, but once completed/expired all new orders must be backed up by 100% escrow.

Moving Forward

These changes will positively impact the market, and better support fair competitive trade between players. Once again, the commitment to fighting botting in all its forms in EVE is absolutely firm, and moving forward with these changes means that the market and the player behavior involved will be closely monitored once these changes are live and in your hands. Further adjustments will be made as necessary, but for now, any open feedback and discussions from the community are welcome as usual, so feel free to head on over to the discussion thread on the EVE Online Forums to take part.